HF Intra-Contract Arbitrage Proposal -20 sep

An analysis of CME self match prevention abuse, Update

Machine Learning -Gradient boosting feature ranking Sept 2025

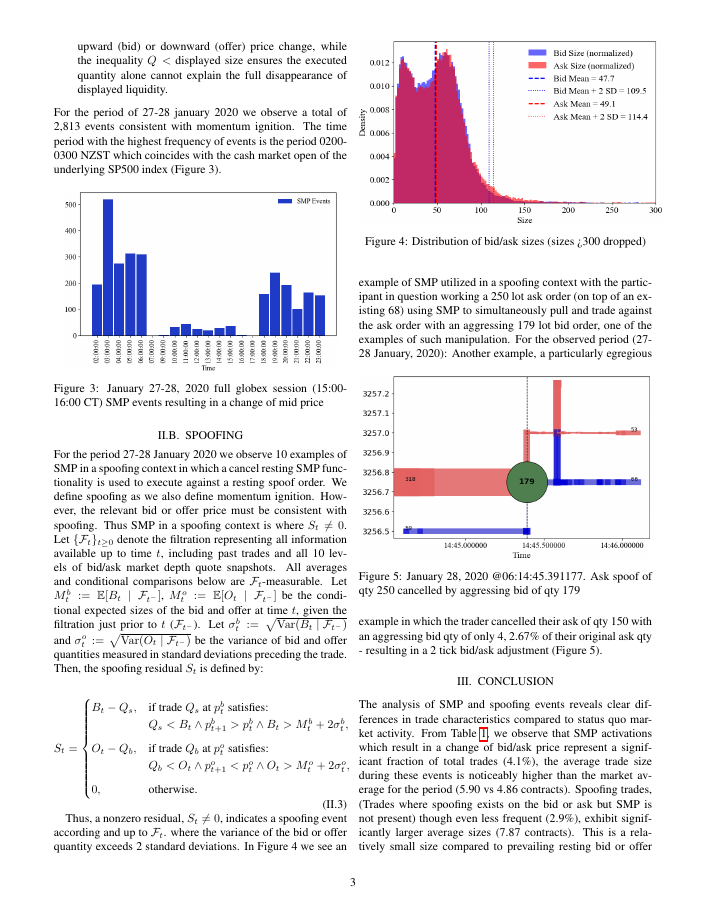

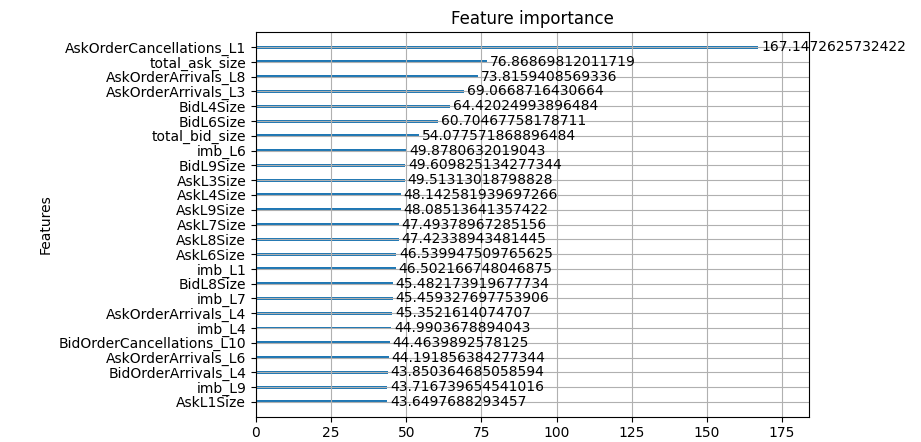

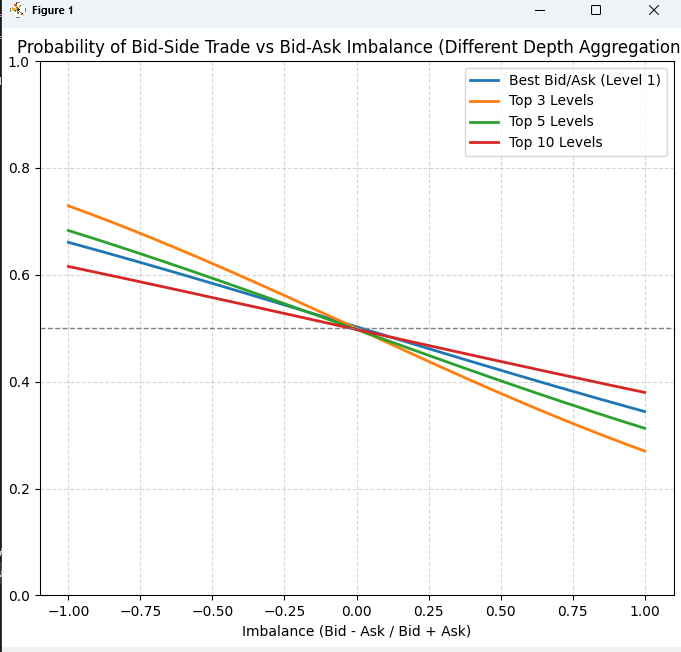

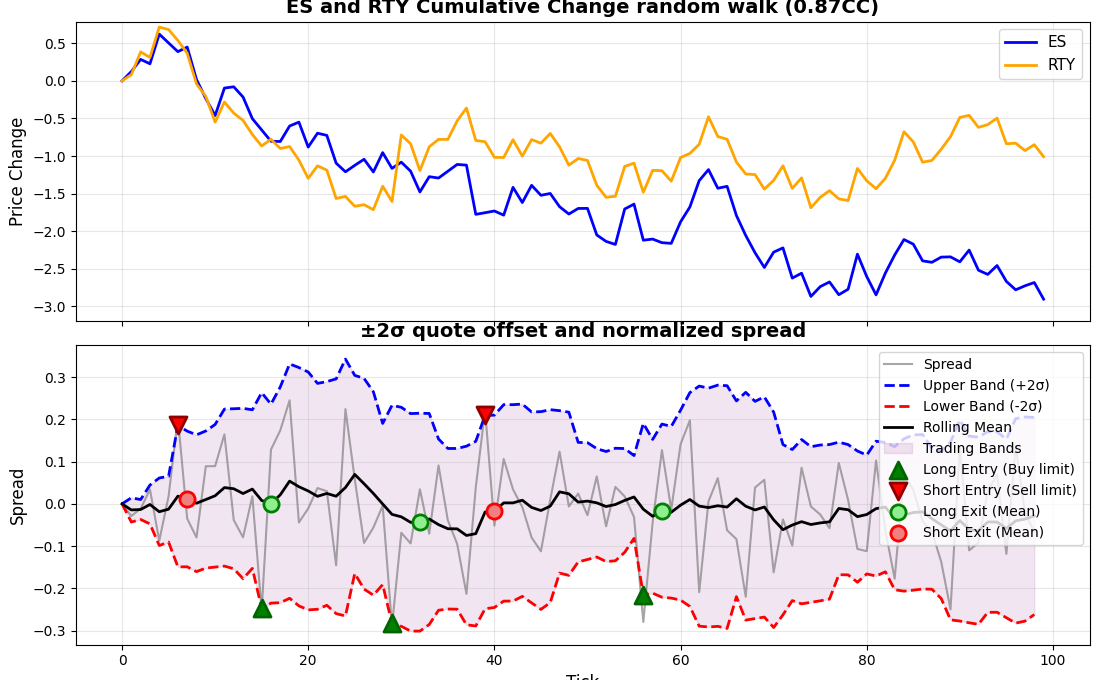

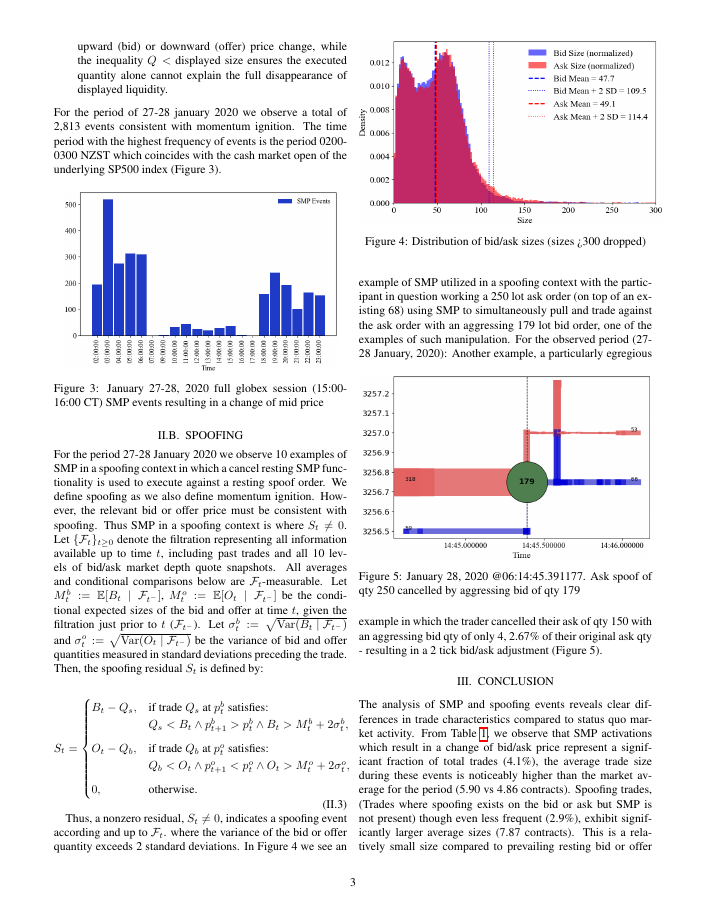

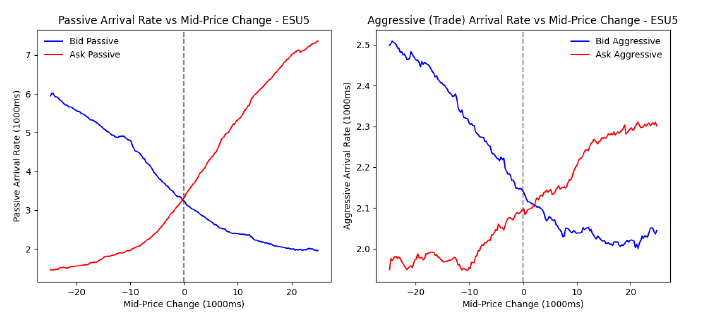

Whilst literature often observes the determinants of the next tick direction (trade or mid price), We observe the feature importance in determining a >1 tick change which I find more actionable when I do not want to use limit orders. All features are observed over 1000ms before mid price change occurs.

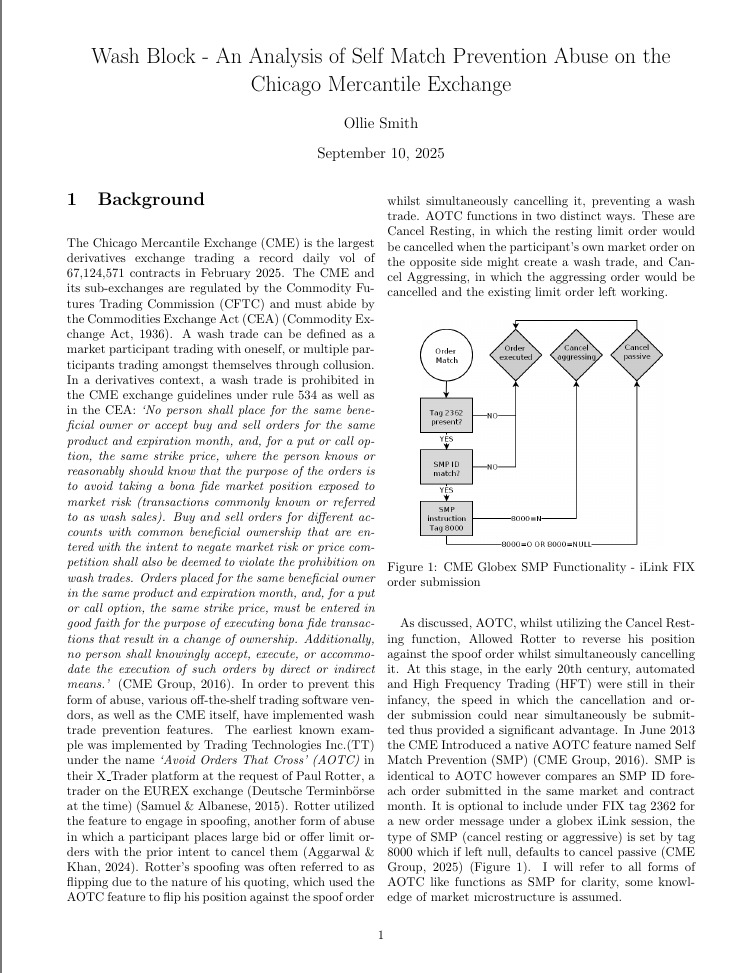

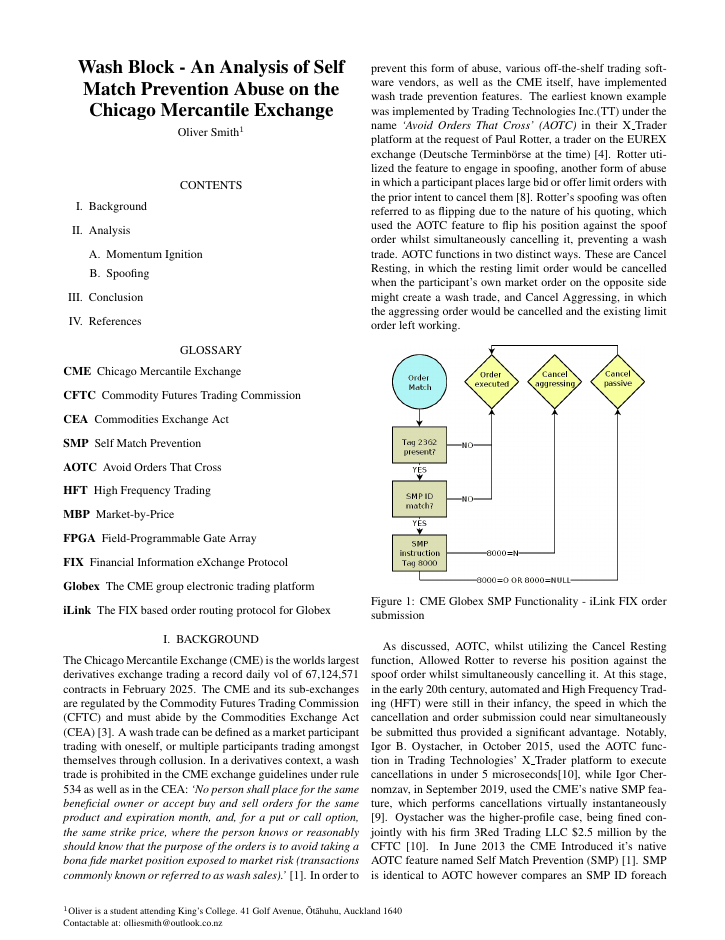

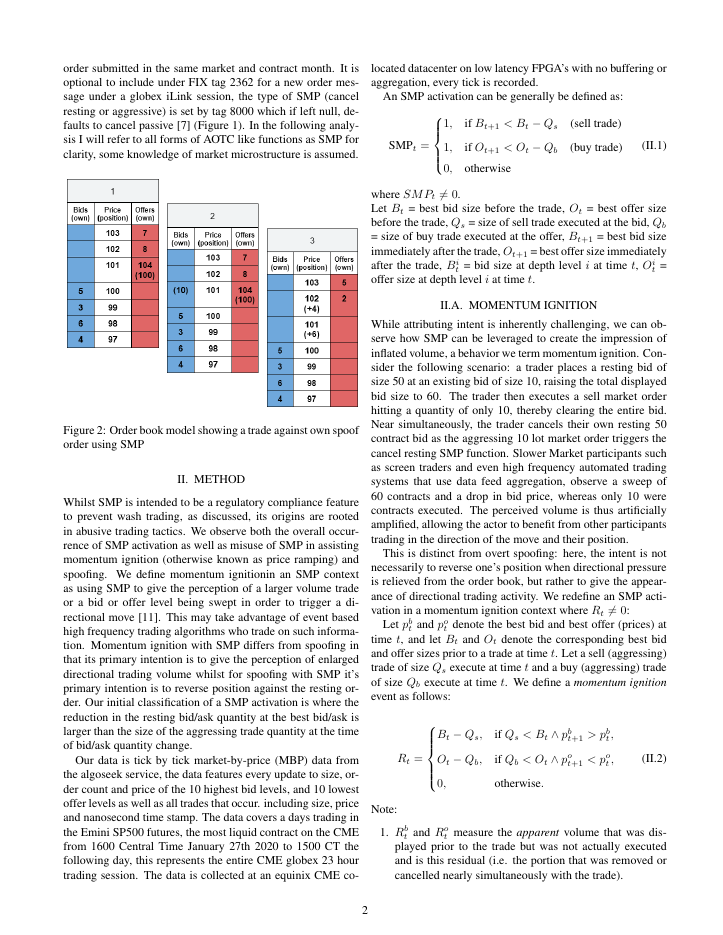

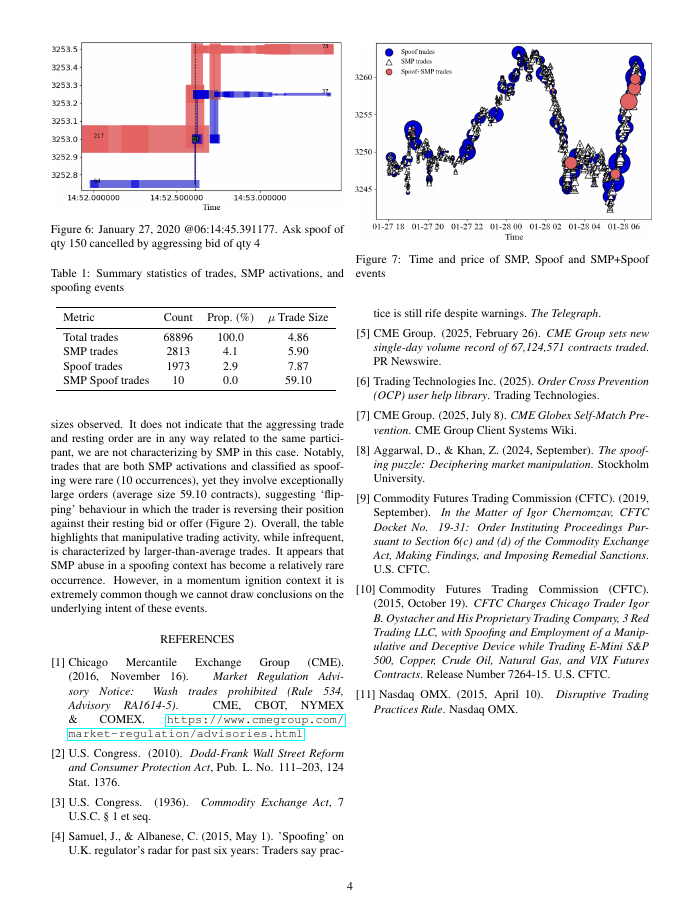

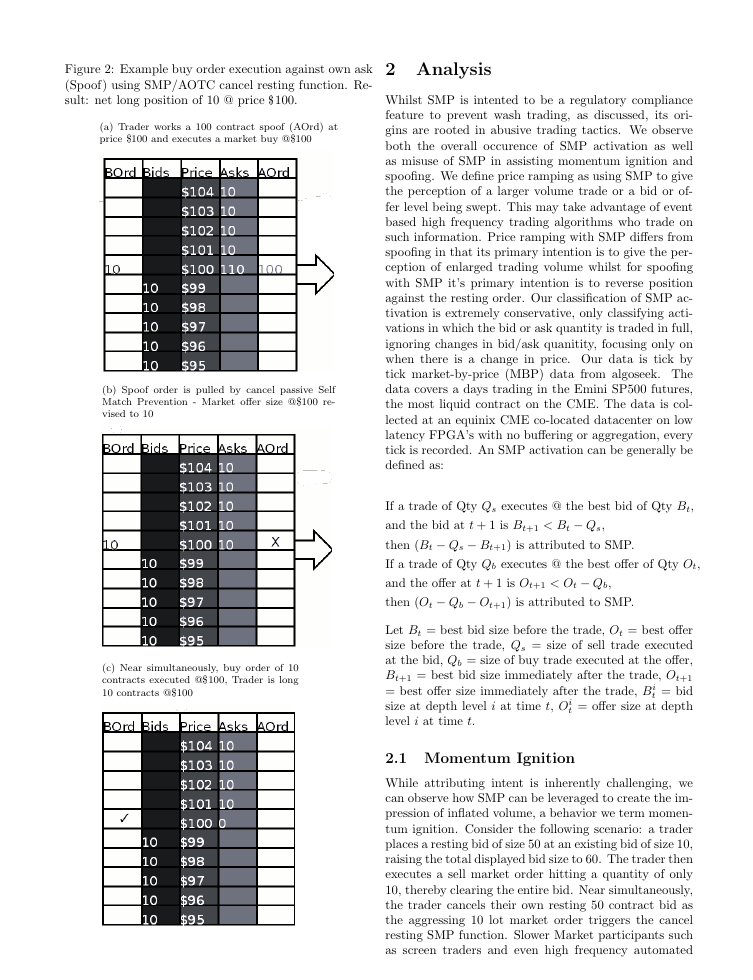

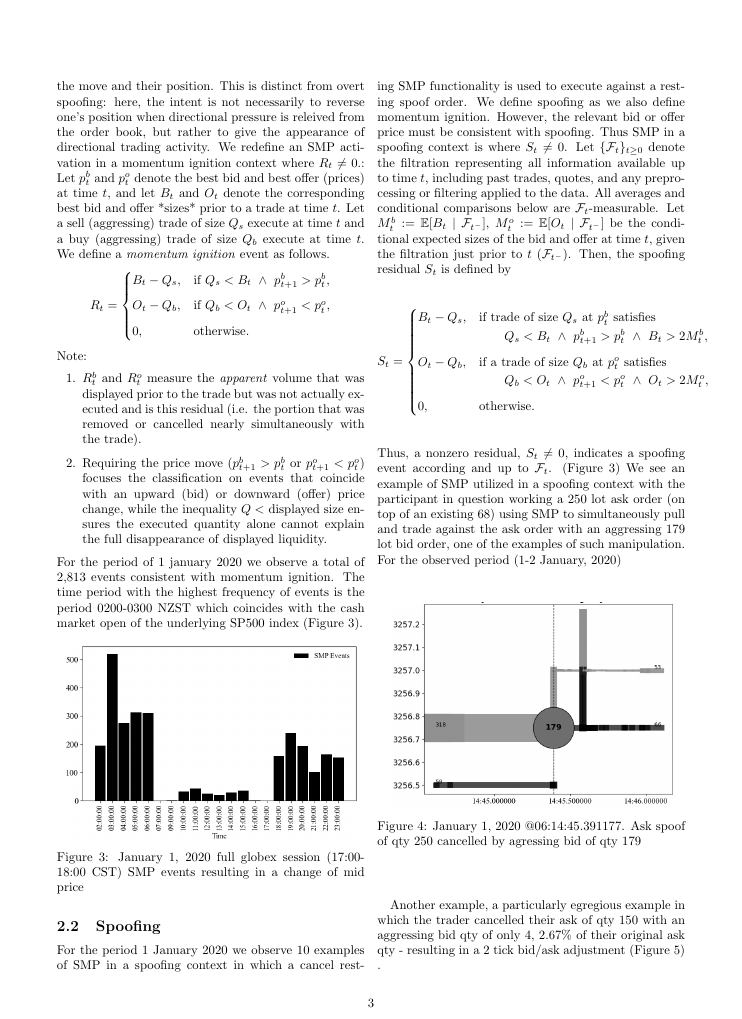

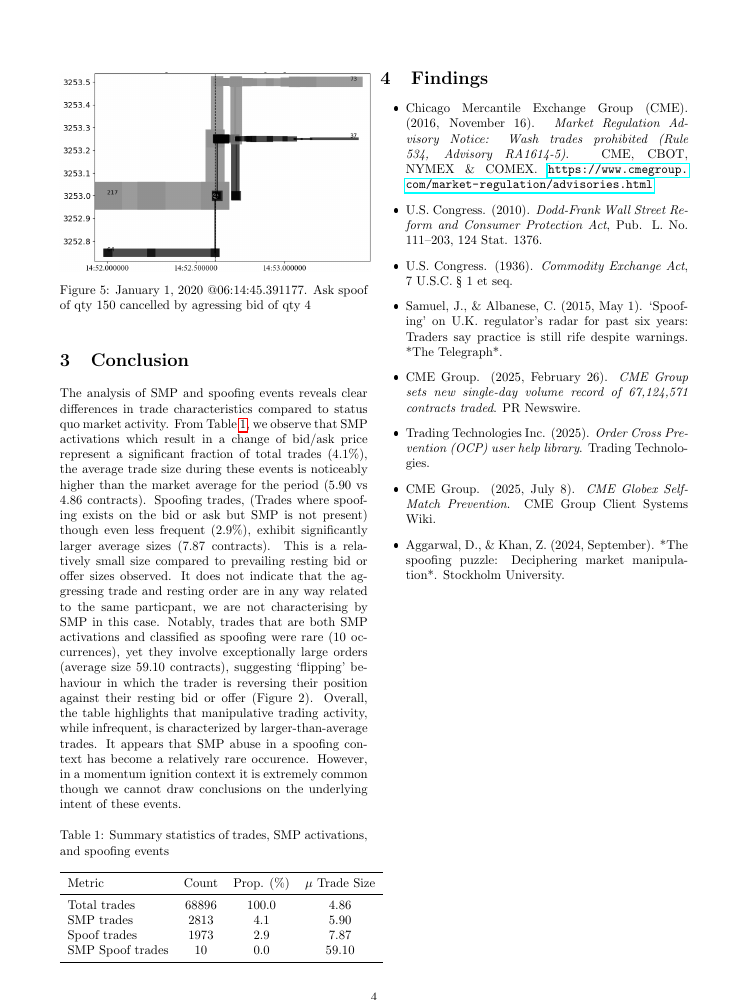

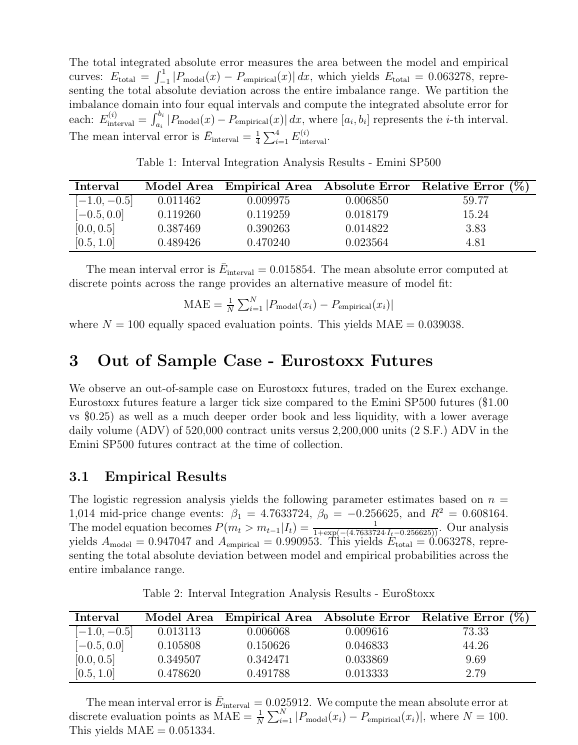

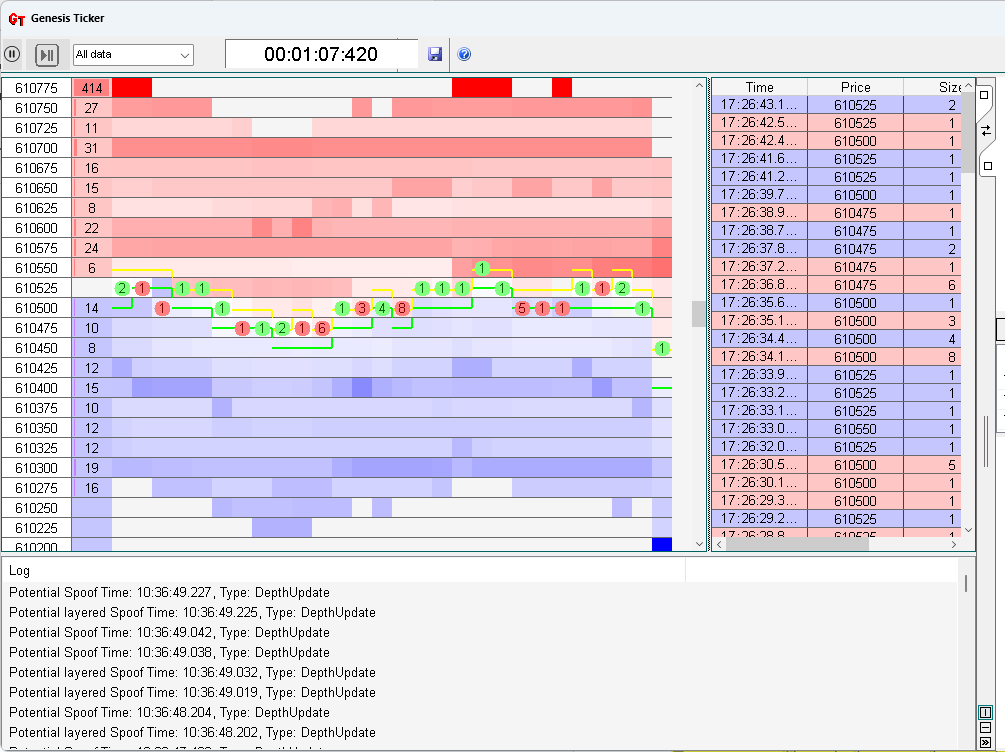

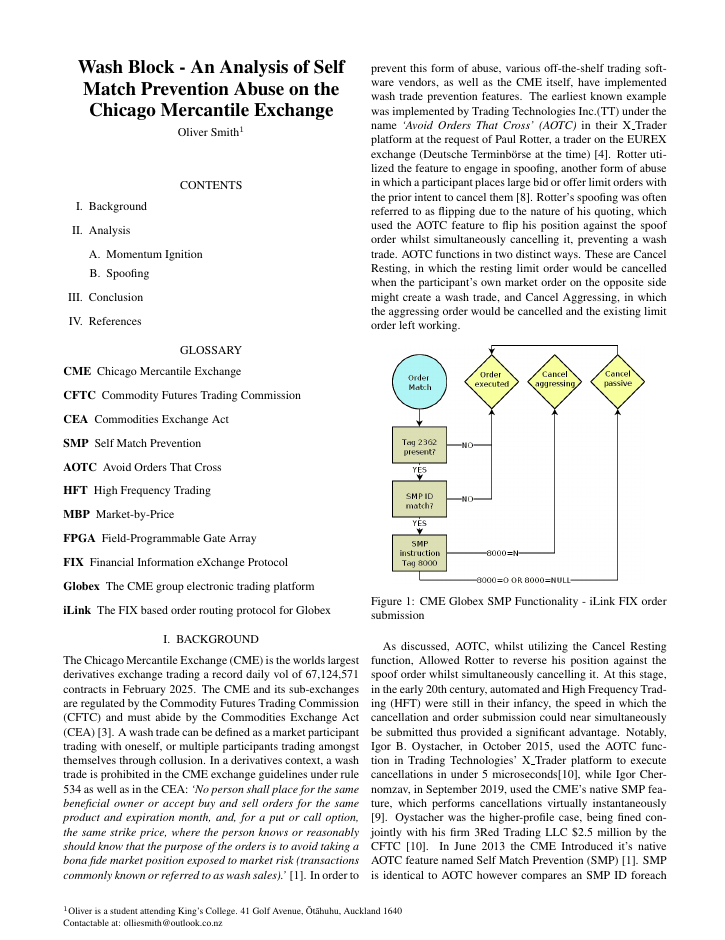

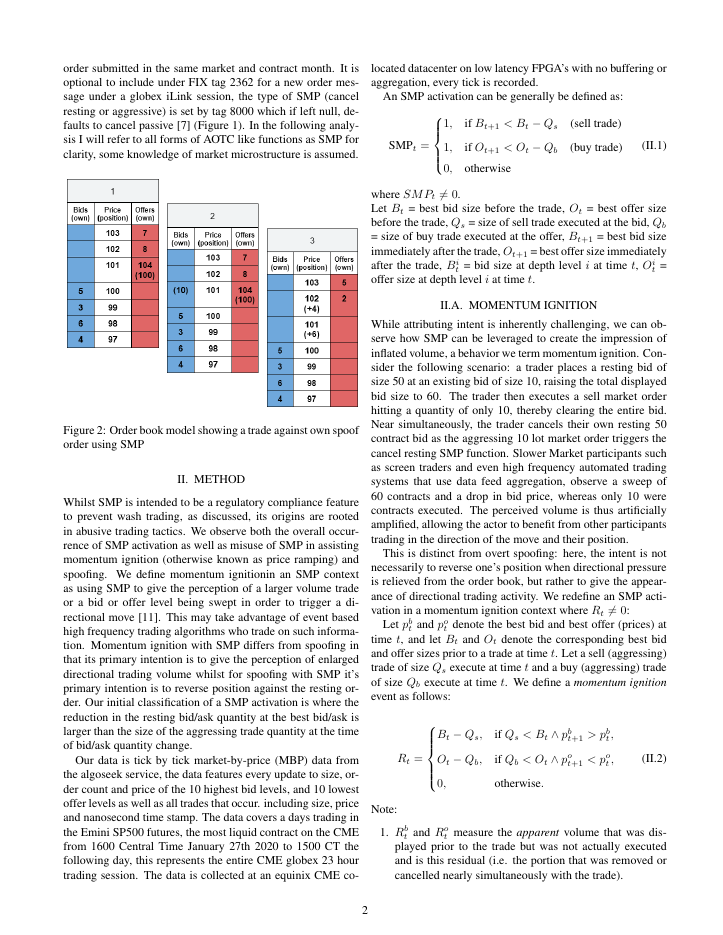

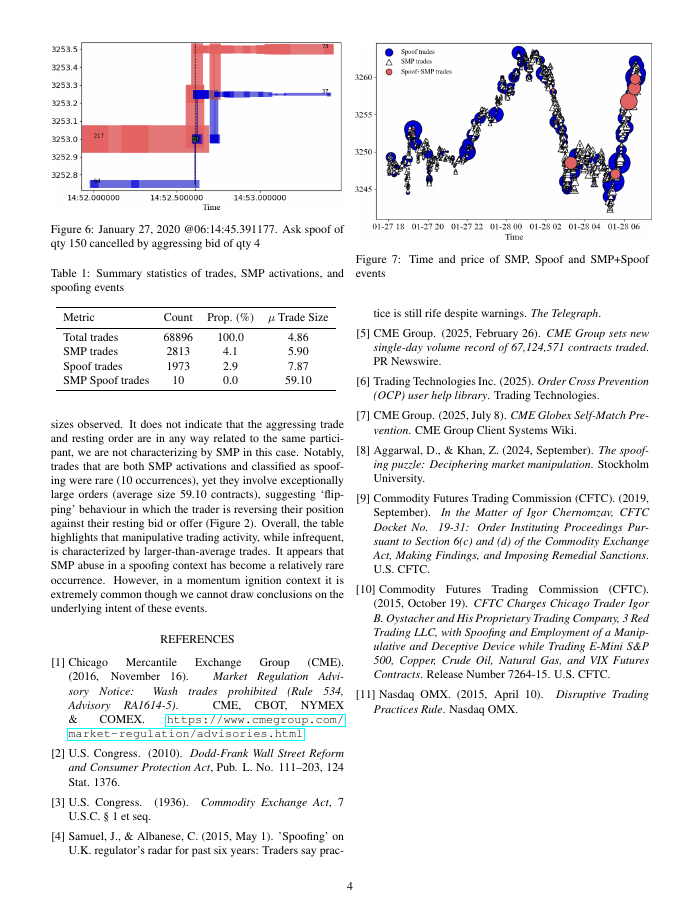

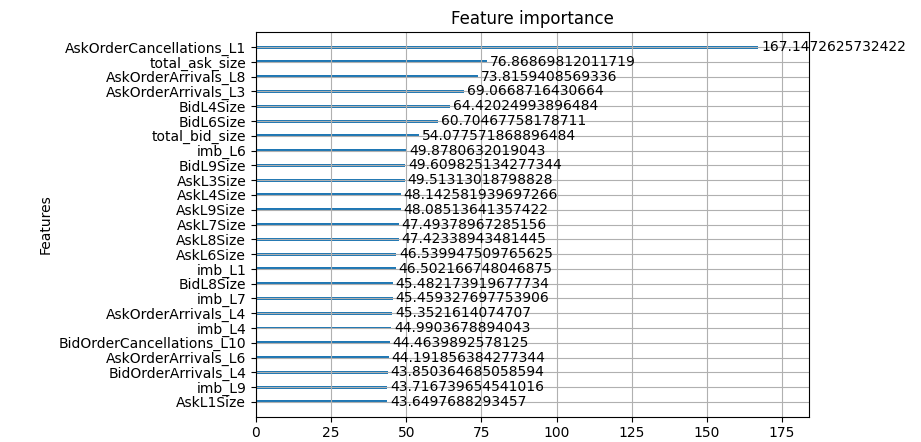

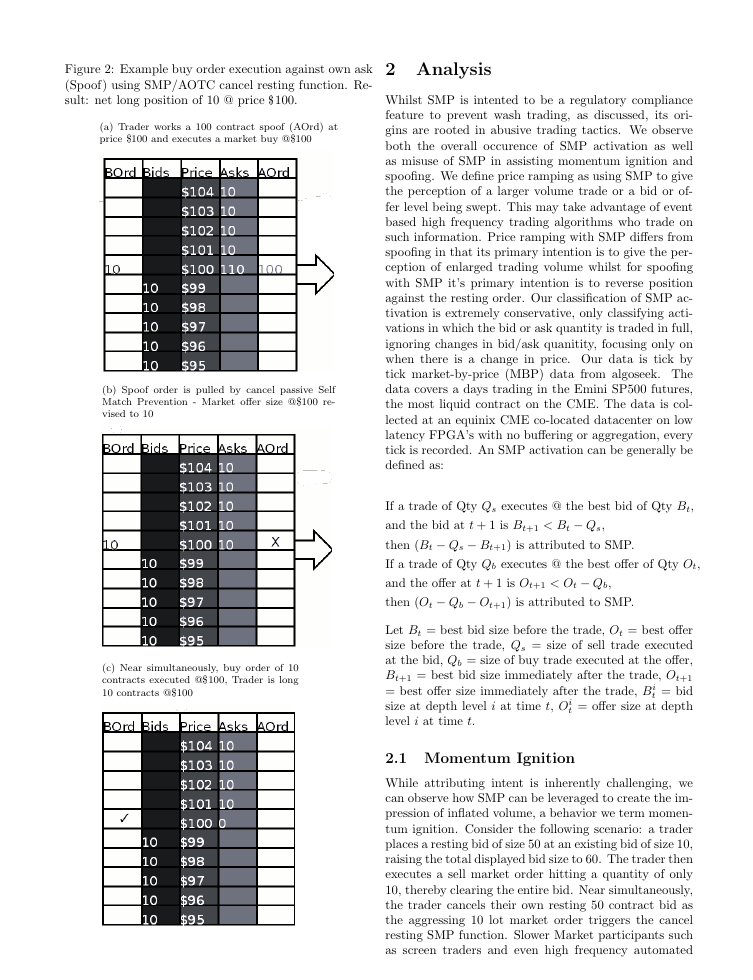

Wash Block - An analysis of CME Self Match Prevention Abuse -Aug 10 2025 draft

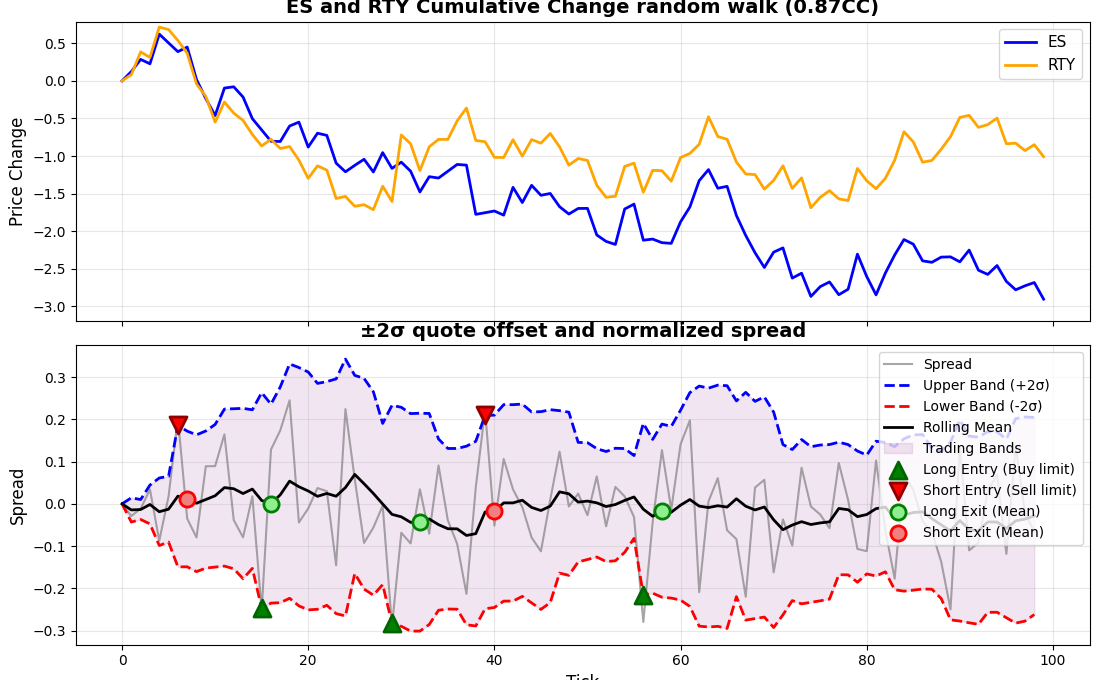

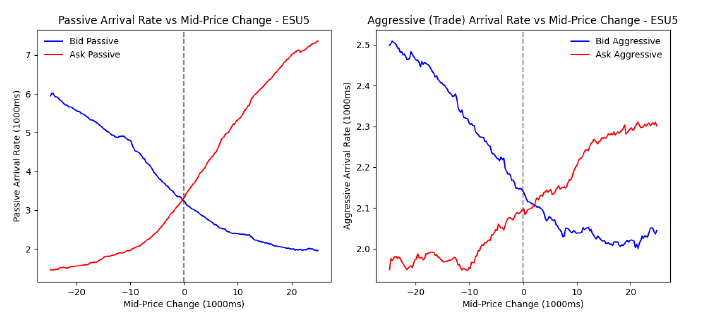

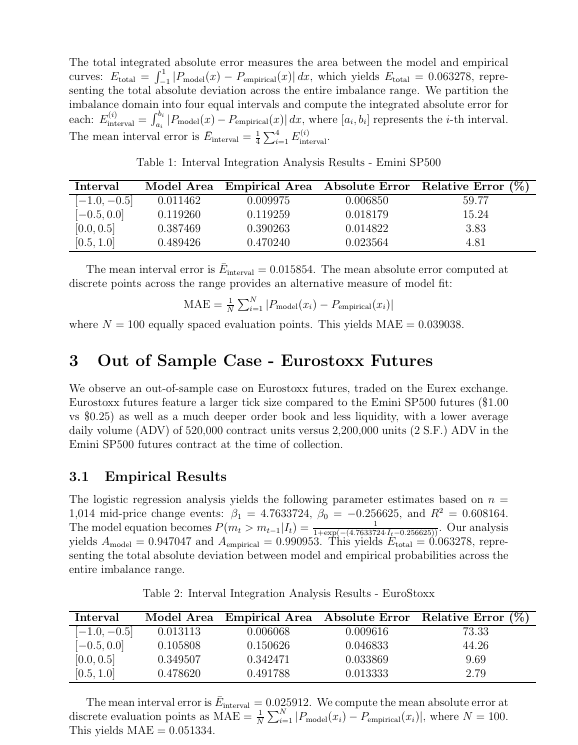

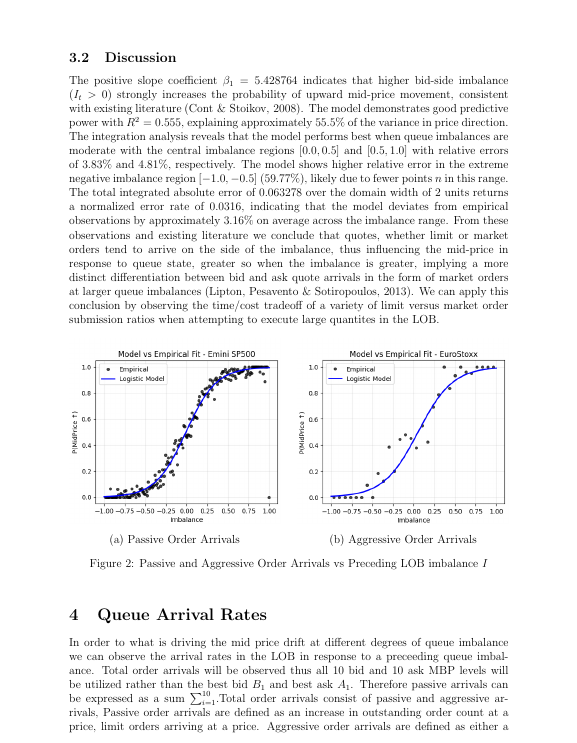

Limit order book dynamics -July 30 2025

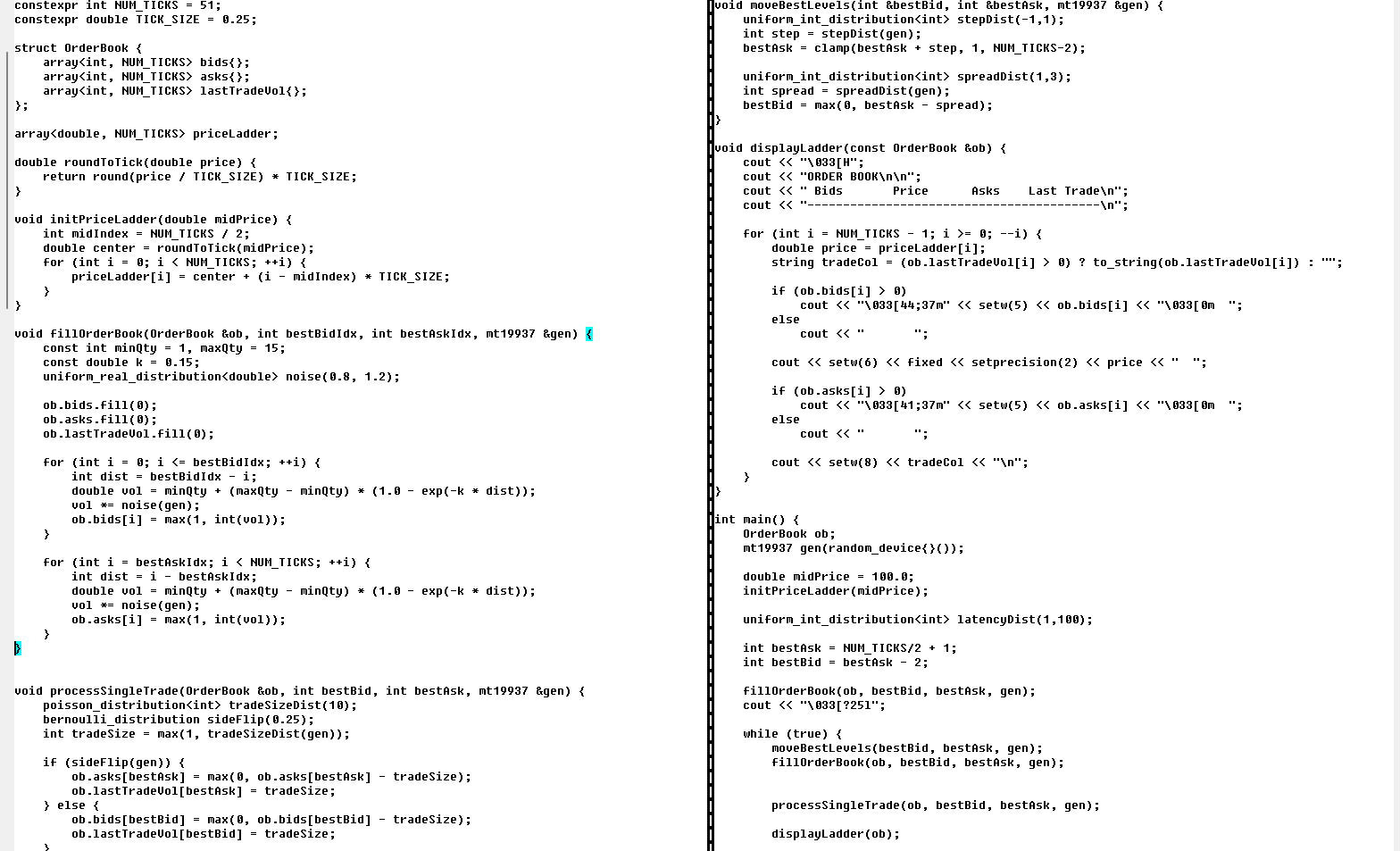

C++ Order Book Simulation -Apr 13 2025

The following is a simple limit order book simulation built in c++. The price evolution is determined by the interaction of limit bid/offer quantities and aggressing trade bid/offer quantities. The arrival and cancellation rate of limit orders and trades is modeled with a Poisson distribution which in the case of limit orders use an exponential function of λ to reduce the size of bids and offers as they approach mid market. The trade arrivals interact with resting limit orders in a standard matching engine fashion, subtracting from resting quantities and causing a change in bid/offer price once fully depleted.

Data Collection

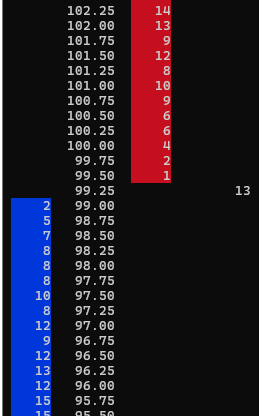

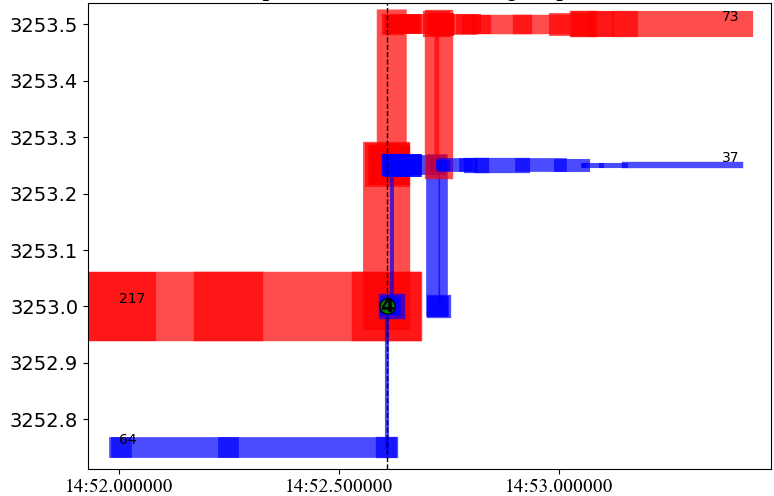

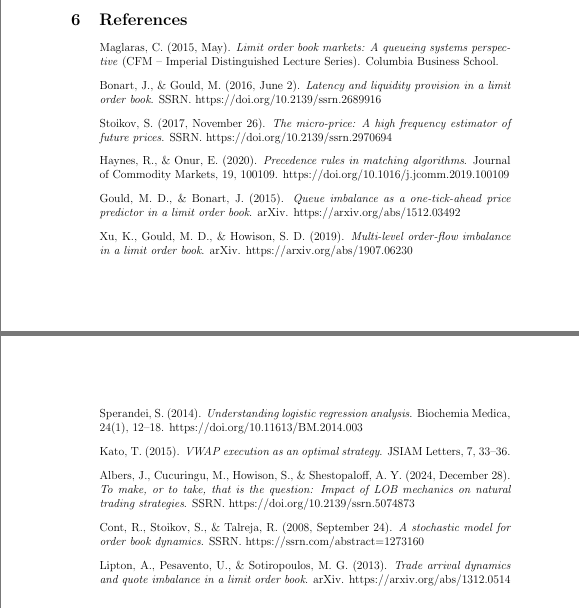

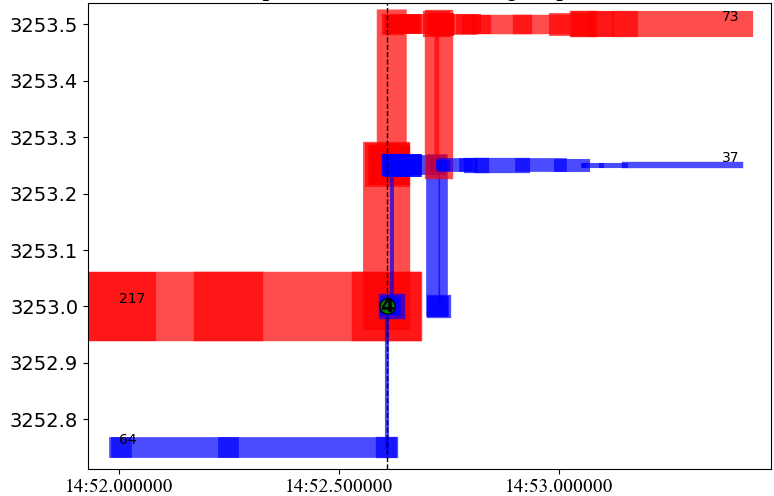

In order to collect limit order book (LOB) data including trades for multiple levels of depth I primarily use a multi-threaded proprietary console application to do so. This app connects to an off the shelf price feed from either Cunningham Trading Systems or Rithmic, with data aggregation and buffering disabled. The app saves the recorded data into a structured CSV with rows of events. I have since developed a GUI based app for an NZQA scholarship project which features some simple models for detecting market abuse in the LOB. The live data is displayed in a heatmap, coloring bid and offer quantities relative to their historical sizes.

Miscellaneous

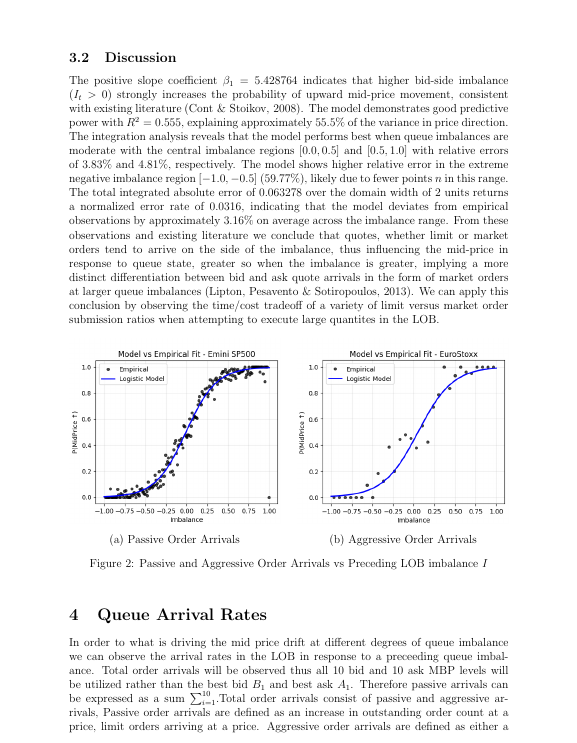

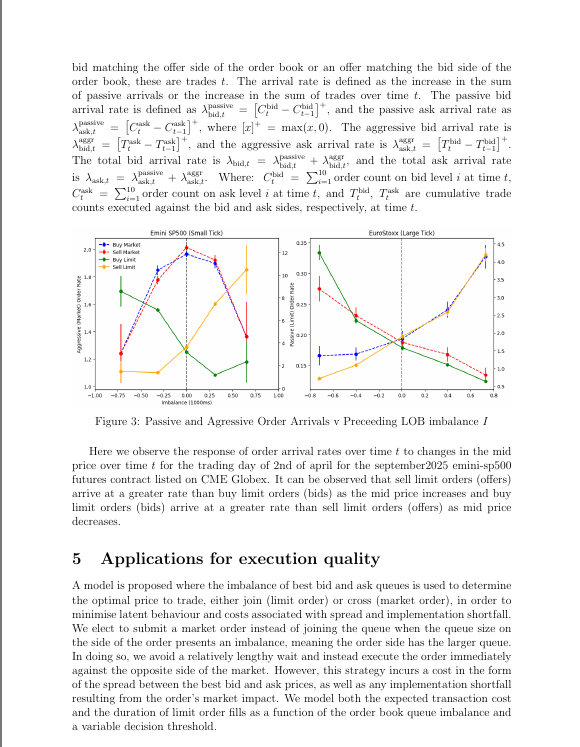

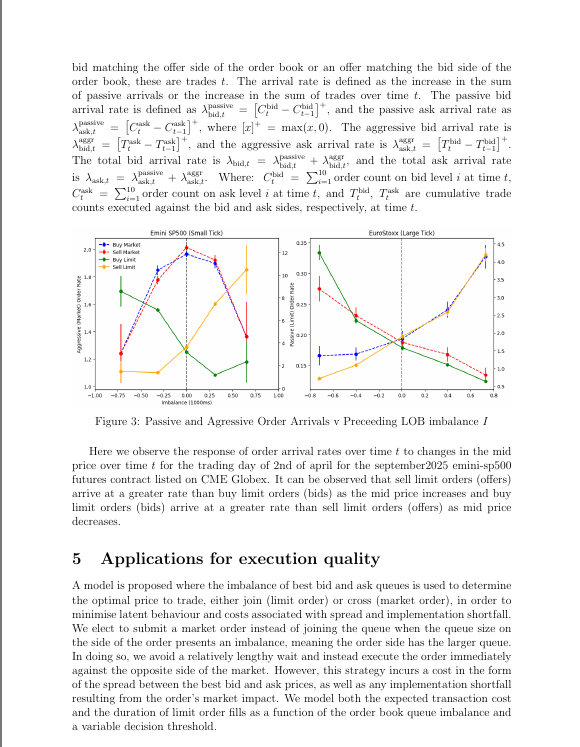

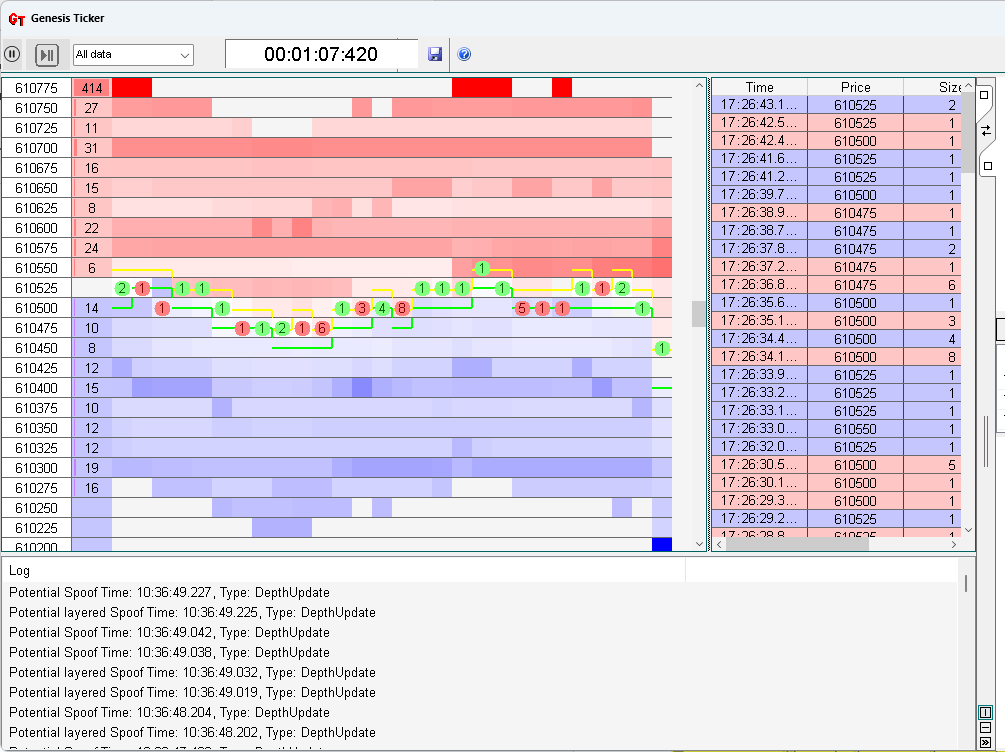

The response of trade and limit order arrival rates to a change in mid price show a cyclical nature of order book imbalance.

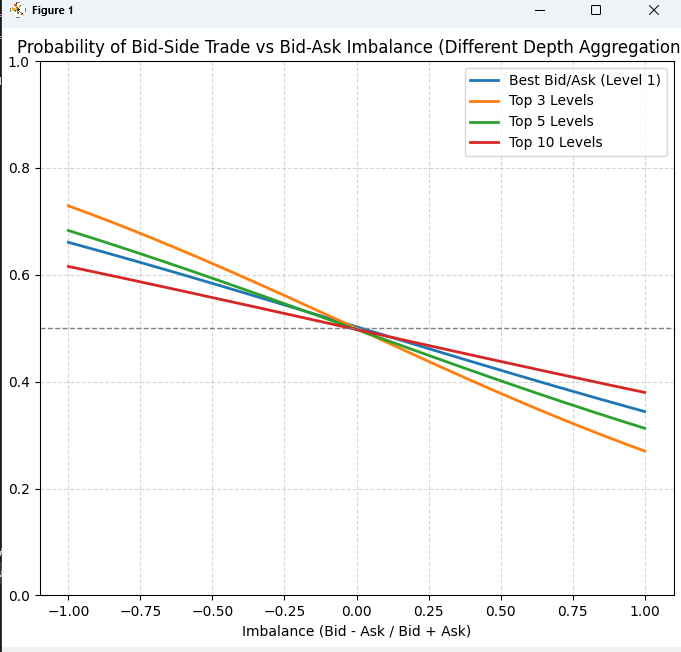

We aim to see which number of market depth levels we should account for in forecasting next tick direction

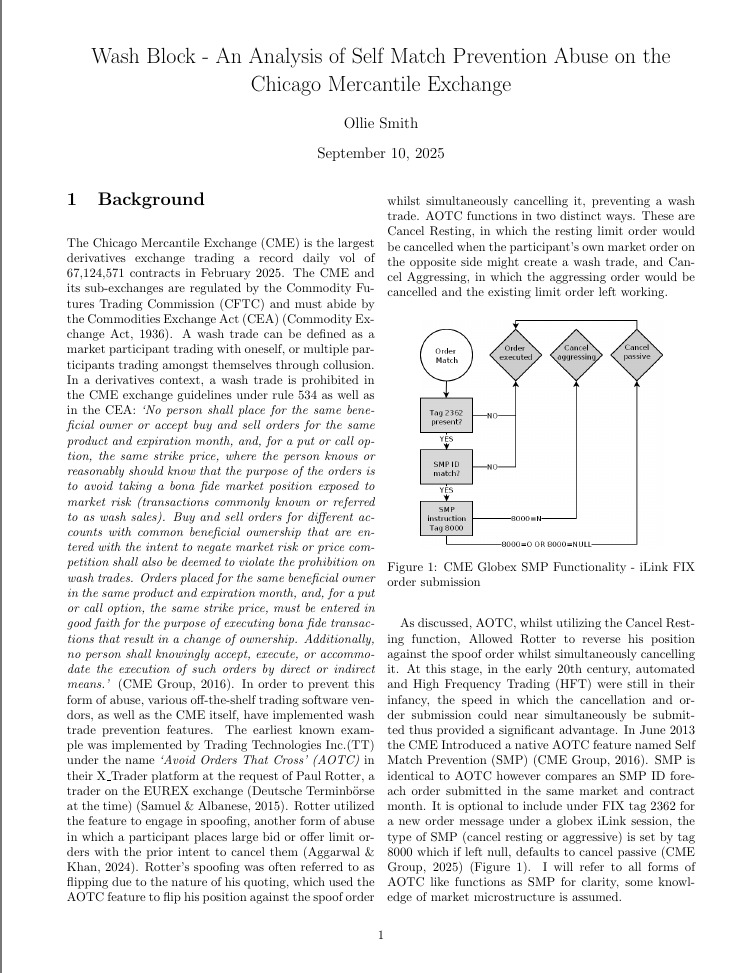

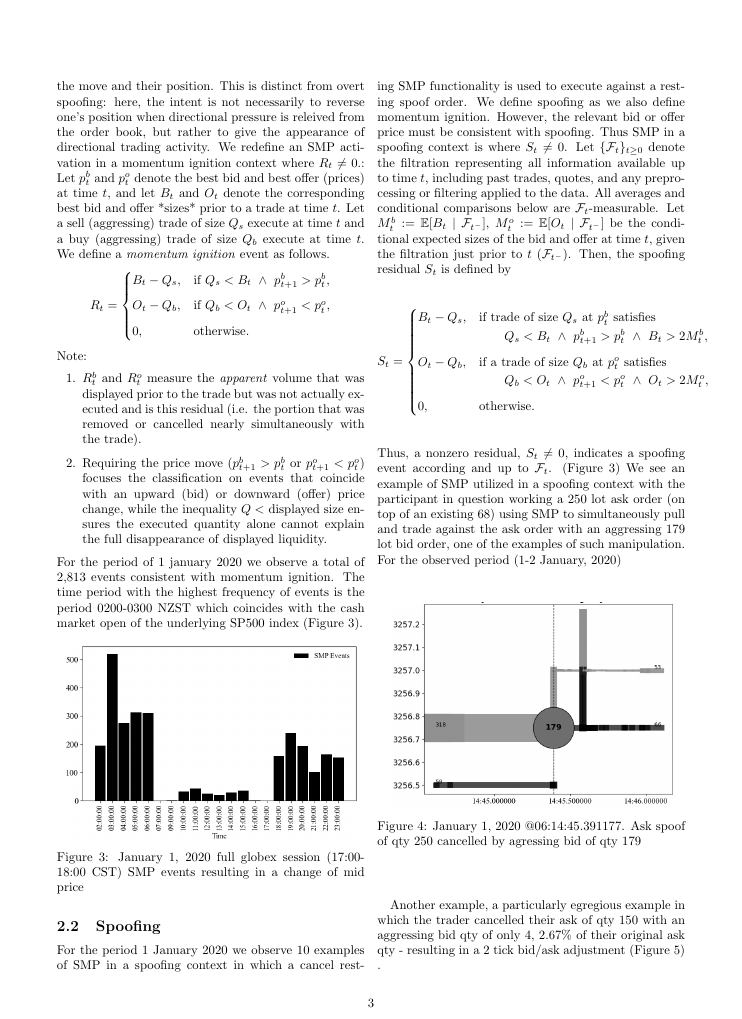

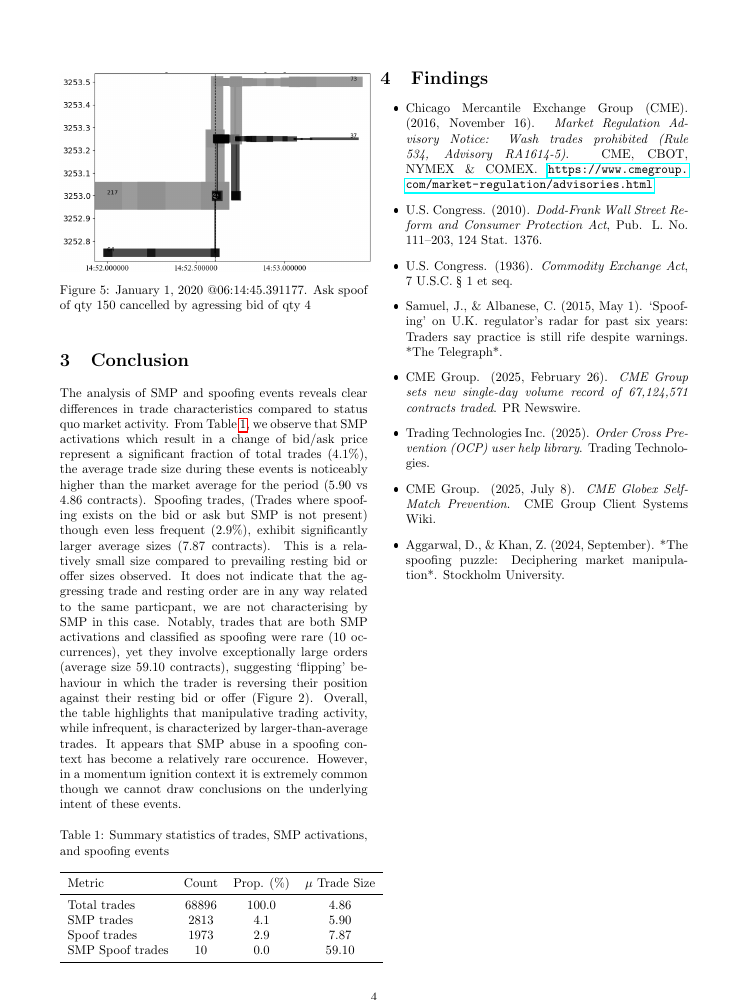

An observed example of spoofing where self match prevention is used to cancel the order, using only 4 contracts.

Machine Learning -Gradient boosting feature ranking Sept 2025